People deposit their money in banks; the bank lends the money out in car loans, credit cards, mortgages, and business loans. The loan recipients spend the money they borrow, the bank earns interest on the loans, and the process keeps money moving through the system.

A bank account is a place for you to deposit and withdraw funds, make payments, transfer money to another person or institution, pay bills electronically, and more. Bank accounts enable you to spend without cash on hand and get direct deposits from employers or other institutions.

banks make money by providing and earning interest from loans [...]. Customer deposits provide banks with the capital to make these loans. Traditionally, money earned in the form of interest from loans often accounts for up to 65% of a banks' revenue model.

Crypto savings accounts can yield higher returns, but are also

subject to market volatility and risk.

This means that you own and control your funds without relying

on banking intermediaries. This level of autonomy provides

greater trust and security in your financial transactions.

Additionally, cryptocurrencies stand out for their lower

transaction costs and faster settlement times compared to

traditional systems.

Cryptocurrencies can offer lower associated fees and more

cost-efficient transactions. Cryptocurrencies may be valuable

tools for implementing the shift to a global, trustless and

open new digital economy.

Cryptocurrency benefits include decentralization, lower transaction fees and inflation protection.

So in conclusion, it is very unlikely that cryptocurrency will replace banks in the near future. Banks may replace certain currencies with cryptocurrencies in the future, for example, the proposed idea of 'Bitcoin', but the value of banks is still too great for them to be made completely redundant.

As Bank use people money to get profit by giving them loans ,and from that profit they become more rich. And people who deposit money get less profit and when they take loans they pay to bank more. Our team did research on that concept and find a way to give maximum benefit normal peoples. Bank use your money for their benefits. We are giving you here an opportunity to help each other and earn beyond limits, Our Motive is “Your Money Your Diligences Your Earning Your Pocket “

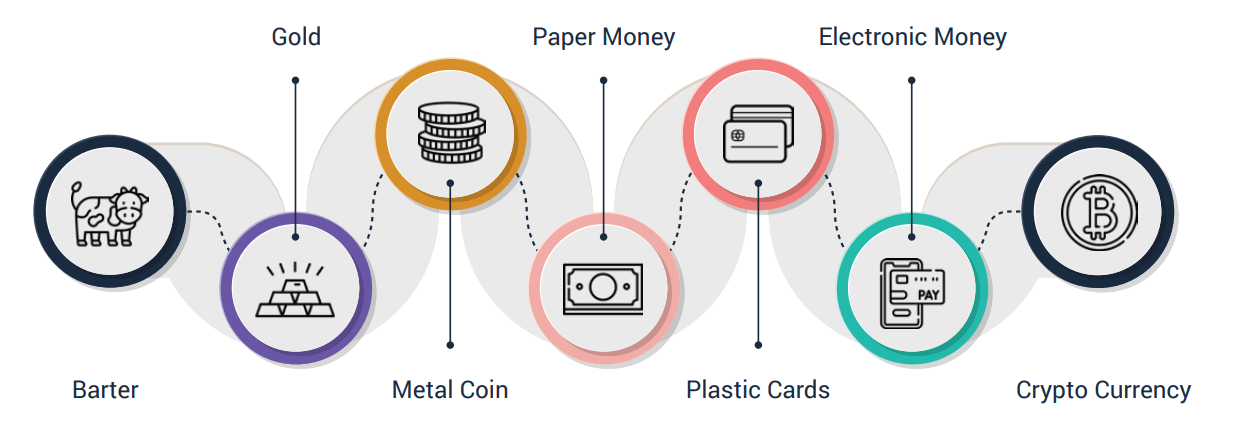

It is a classical arrangement through which people get what they do not have by trading with what they do have. An example of barter trade is exchanging butter for bread.

Trading refers to the buying and selling of stocks, bonds, commodities, currencies, or other financial securities for a short period to earn profits

Cryptocurrency comes under many names. You have probably read about some of the most popular types of cryptocurrencies such as Bitcoin, Litecoin, Tron and Ethereum. Cryptocurrencies are increasingly popular alternatives for online payments. Before converting real dollars, euros, pounds, or other traditional currencies into ₿ (the symbol for Bitcoin, the most popular cryptocurrency), you should understand what cryptocurrencies are, what the risks are in using cryptocurrencies, and how to protect your investment.

What is cryptocurrency? A cryptocurrency is a digital currency, which is an alternative form of payment created using encryption algorithms. The use of encryption technologies means that cryptocurrencies function both as a currency and as a virtual accounting system. To use cryptocurrencies, you need a cryptocurrency wallet. These wallets can be software that is a cloud-based service or is stored on your computer or on your mobile device. The wallets are the tool through which you store your encryption keys that confirm your identity and link to your cryptocurrency.

What are the risks to using cryptocurrency? Cryptocurrencies are still relatively new, and the market for these digital currencies is very volatile. Since cryptocurrencies don't need banks or any other third party to regulate them; they tend to be uninsured and are hard to convert into a form of tangible currency (such as US dollars or euros.) In addition, since cryptocurrencies are technology-based intangible assets, they can be hacked like any other intangible technology asset. Finally, since you store your cryptocurrencies in a digital wallet, if you lose your wallet (or access to it or to wallet backups), you have lost your entire cryptocurrency investment.

Follow these tips to protect your cryptocurrencies: